Floods, especially in the coastal regions of the United States are of particular interest these days. Estimating your chances of being involved in one, is a business used by insurance companies that, unfortunately, is booming. What is a 100-year flood zone?

A 100-year flood is a simplified measurement that FEMA created to give the odds of a flood happening in that zone or area. In odds, it is a 1 in 100 or a 1% chance or probability of the event happening. It can give you and others an idea of the risk of flooding and loss to your property.

Floods occur for many different reasons. I lost my home in Hurricane Sandy in 2012 in New Jersey. I knew very little about the subject of Flood Insurance, 100-year Flood Plains, Zones and Flood Elevation, and the risk of living on the coast as the earth’s ocean warms and sea levels rise.

How Are Flood Zones Determined

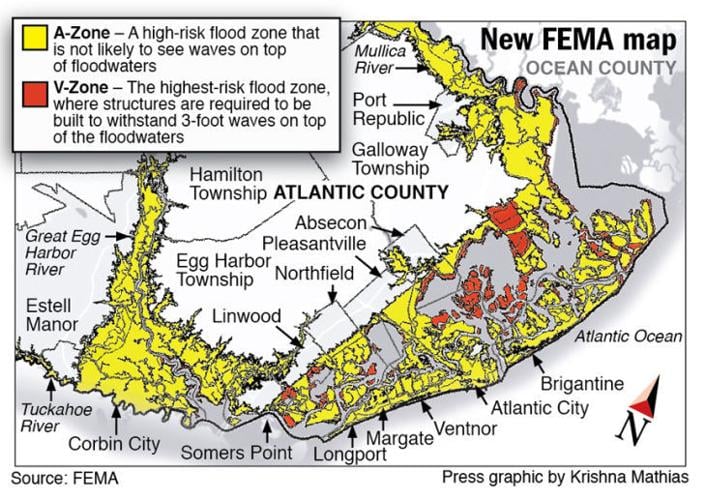

The Determinator, which is the company providing the Flood Zone Determination, will use FEMA’s flood maps, the county’s parcel maps, aerial photography, and other maps to figure out which flood zone is applicable to the property. It can determine what properties are located in a specific Flood Zone. In the 1960s, the United States government decided to use the 1 percent annual exceedance probability (AEP) for floods as the basis for the National Flood Insurance Program.

Scientists use statistical probability (chance) to put a context to floods and their occurrence. If the probability of a particular flood magnitude being equaled or exceeded is known, then risk can be assessed. That can be used for information that is passed on for different reasons. If the probability of a particular flood magnitude being equaled or exceeded is known, then risk can be assessed for that area.

Scientists use statistical probability (chance) to put a context to floods and their occurrence. If the probability of a particular flood magnitude being equaled or exceeded is known, then risk can be assessed. That can be used for information that is passed on for different reasons. If the probability of a particular flood magnitude being equaled or exceeded is known, then risk can be assessed for that area.

To determine these probabilities all the annual peak streamflow values measured at a stream gauge are examined. A stream gauge is a location on a river where the height of the water and the quantity of flow (streamflow) are recorded by a Gauge Station.

Information is gathered in the areas along rivers and waterways, and collected in a certain place, called a Stream gauge. The stream gauge is operated by The U.S. Geological Survey (USGS) and runs more than 7,500 stream gages nationwide that allow for the assessment of the probability of floods.

The most important data that is collected is the rising river water and inlet levels and climate changes along with river drainage changes. Most city officials and water managers often are more concerned with the height of the water in the river (river levels) than the streamflow quantity. United States Geological Survey (USGS) personnel wade in the water near a Stream gauge Station and take sets of measurements to make the measurement or do so from a boat, bridge, or cableway over the stream.

For each Gauging Station, like this one in the picture, a relation between gauge height and streamflow is determined by simultaneous measurements of gauge height and streamflow over the natural range of flows (from very low flows to floods).

This relation provides the current condition streamflow data from that station. Then the other factors are also measured like rainfall or water velocity past the station along with water quality in the area of the Station. All the information is used to calculate real-time statistics

How Do I Find My Flood Zone

It’s important to know if your home was built on a Flood Plain and if you are selling or buying for various reasons the information is available. Any construction and building in the area can change your zone without any notice so you need to check that information every 5 years or so.

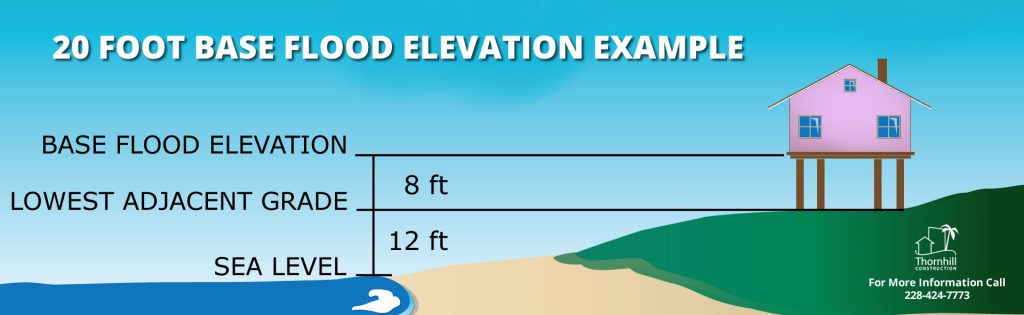

You can do this by checking the FEMA website. You can see where my home was mapped in the AE Flood Zone. We were at 8 Foot Base Flood Elevation. Fill in your address and Your search will bring up a Flood Insurance Rate Map (FIRM) for the area where your property is located.

These tools can help you find out the cost of Flood Insurance for your area. Some calculators give you estimates of possible losses if your home suffers from a flood.

FEMA placed more than 20,000 communities in the United States in a category called Flood Zones. Each one of these communities is able to participate in the Agencies National Flood Insurance Program. FEMA attached a letter to each zone that indicates how likely the risk of flooding is in their part of the area they are in.

The most hazardous Zone is V which is located in the first row like a beach-front home and A that are normally right on the edge of a body of water. Any building located in the A or V Zone is considered to be in a special flood hazard area and is lower than the Base Flow Elevation.

V Zones are the most hazardous of the Special Flood Hazard Areas. These properties are usually located on the beach and are susceptible to wave velocity. Zones B, X, and C are the lowest risk.

A 1% annual risk of being flooded was the line FEMA drew. Being in or out of the 100–year flood zone is just the requirement for mandatory flood insurance purchase.

If you are a buyer or a seller in a realty transaction, the location of the property in the Flood Zone will have an effect on the price of the home. Most likely the seller will adjust the price of the home so that it reflects the Flood insurance as part of the price so that there won’t be any hidden surprises. The buyer could see the home as less desirable because of the location in the flood zone.

My home in New Jersey was listed in the AE Zone so, after Hurricane Sandy, I built some changes to my house like raising the Water heater and Gas Furnace Systems and Electrical Breaker boxes higher up the wall also located off the first floor.

An area designated AE presents a 1 percent annual chance of flooding. Because flood zone AE is prone to flooding, property owners with mortgages from federally regulated lenders in these zones must buy flood insurance if they live in a community that participates in the National Flood Insurance Program (NFIP).

We (South Jersey residents) were told that these flooding and storm events were to be expected more and more. We needed to be more prepared. We just experienced a hurricane the year before. Also, an Earthquake that actually knocked me off my couch earlier in the summer. Yes, I said an Earthquake!

I made an easy shut-off system at the gas meter, which was a problem for me and most of my neighbors during the Hurricane. A homeowner needs to be able to shut off the gas before evacuating the home during an emergency storm as we experienced during Sandy. This was a reason for the explosions where I lived in Mullica River because of the floodwaters surging through pushing houses off their cement pads and separating gas meters and piping. It was an amazing sight to see and you could actually hear them when they happened.

There were numerous explosions from leaving the gas on during evacuation. Huge waves so powerful came through and pushed up against the smaller homes. They slid the homes off the cement pads igniting the gas and causing explosions.

The National Flood Insurance Program

The National Flood Insurance Program assists in reducing the impact of flooding on private and public structures. It does so by providing affordable insurance to property owners, renters, and businesses and by encouraging communities to adopt and enforce floodplain management and its regulations.

These efforts help mitigate the effects of flooding on new and improved structures. Overall, the program reduces the socio-economic impact of disasters by promoting the purchase and retention of general risk insurance, but also flood insurance, specifically.

According to The NFIP:

- In high-risk flood areas, there is at least a 1-in-4 chance of flooding during a 30-year mortgage.

- Nearly 20% of all flood insurance claims come from moderate to low-risk areas.

- Disaster assistance, if it’s available, is typically provided as a loan that must be repaid with interest. This applies to those who qualify for assistance but did not have flood coverage. The Small Business Association was the institution used in Sandy in Jersey. To apply for the loan, you needed to buy the National Flood Insurance if you did not have it.

- There is a 30-day waiting period for all new flood policies unless it’s required for closing on a new home purchase.

- From 2007 to 2011 the average residential flood claim amounted to almost $30,000.

The National Flood Insurance Program uses the Flood Elevation Certificate to certify the base flood elevation of residential and commercial buildings. A Licensed Land Surveying firm Engineers & Surveyors in New Jersey completes the Flood Elevation Certificate. The results are used with the Flood Zone Maps to determine what you will pay for insurance. This is an added cost when you buy a home in New Jersey and Pennsylvania a kind of surprise that is penciled in.

What Does Base Flood Elevation Mean

The average price for Flood Insurance through the National Flood Insurance Program is around $700.00 a year but in higher-risk flood Zones, that policy can be as high as $6,000.00 a year and in some cases 10,000 dollars a year.

Flood insurance is determined by a few factors. The most influential of which are:

- The flood zones in which the home is located

- The elevation above sea level also referred to as the base flood elevation

- The methods of construction, including breakaway walls, foundation systems, and the number of flood vents

With new guidelines that come out every few years, Flood Insurance for people like myself and my neighbors became scarier after Hurricane Sandy. Because the government has the power to make changes, every few years to the Flood Zones. Here on the Bay side of Jersey, tens of thousands of people live in Cape Cod or single-level ranchers that are modest homes.

Typically these types of residential homes have a very low foundation or were built on a slab. Now, with the new flood guidelines in place, many of these homes find themselves below Base Flood Elevation which will increase their cost of insurance and force them to have to raise their houses or else pay even more money for flood insurance. How this risk assessment is handled in the next couple of decades will be a mystery. As the sea level gets higher and the floods increase where will the coastal inhabitants go?

Up I’m pretty sure.

References:

8 Things To Understand Before You Buy A Home In A Flood Zone

The National Flood Insurance Program